When friends and colleagues gather for a meal, the joyous atmosphere normally dims when the waiter presents a single aggregated bill. In that moment, mental calculations take center stage for bill-splitting, and in an instant, calculators are out, brows furrow, lips tighten and there are glances exchanged between friends. The absence of change for large bills or a miscalculation can strain even the closest bonds.

This scenario is a snapshot of a larger reality experienced by countless groups worldwide, where the process of splitting bills often becomes an unintended obstacle course. Be it a meal among friends, a collective gift purchase, or splitting expenses during a trip, the challenges remain persistent—fairness, transparency, and the hassle of dealing with physical cash.

It’s this ordeal that Brian Amanya, Arnold Kiirya, and Yvette Wambi Nerima—encountered firsthand. The trio, amidst their bustling lives and shared experiences, recognized the nuances and intricacies inherent in managing shared expenses. This planted the seed for their brainchild, SharePay.

“Conflicts arise in instances of shared bills, be it colleagues dining together or friends celebrating a birthday where a single bill is presented,” Brian Amanya, the team leader for the startup, said while he shed light on the genesis of SharePay.

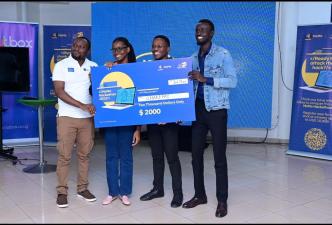

The three innovators submitted their innovation, SharePay in the 2023 MTN MoMo Hackathon where in the end emerged as 2nd runners-up winning a cash prize of USD$2,000 (approx. UGX7.6 million) to further improve and grow their startup.

SharePay provides a seamless, secure, and fair method for individuals to share expenses, eliminating the inherent hassles and conflicts often associated with such transactions.

SharePay steps in to simplify this by offering a unified platform where multiple groups can be created, enabling transparent tracking of contributions using MTN Mobile Money.”

How SharePay works

A key feature of the MTN MoMo Hackathon was that all developers and entrepreneurs created groundbreaking mobile applications that leverage the MTN Mobile Money Application Programming Interface (APIs).

Consequently, these applications all utilize modern capabilities of V2.1 apps such as the ability to make notifications, carry out Know Your Customer (KYC) operations, KYC, and authorization among other things. The apps also enjoy V2.2 (Channel as a Service) capabilities to cover use cases beyond payments, thereby fostering a comprehensive and inclusive digital financial ecosystem.

Amanya explained that SharePay’s core functionality revolved around creating groups for various purposes, whether it’s contributing to a wedding fund or sharing school fees payments. He emphasized the traditional methods of splitting group bills where disparate individuals send money separately are rife with inefficiencies and make individuals incur high charges.

Amanya said that SharePay aims to mitigate these inefficiencies by centralizing contributions, reducing individual transaction charges, and fostering transparency in expense sharing. He pointed out that the platform’s features are designed to ensure security and transparency.

“We prioritize security by verifying users through OTP (One Time Password) confirmation tied to their phone numbers,” remarks Amanya. “Moreover, individuals have the autonomy to accept or decline group invitations, ensuring a secure and consent-based environment.”

The platform’s central concept lies in providing a single, secure space where group members can view individual contributions, track total group contributions against predefined goals, and execute payments seamlessly through MTN mobile money.

This streamlined approach eliminates the need for constant change searches during group payments, ultimately reducing discrepancies and conflicts.

“SharePay aims to be a transparent and secure platform that offers a holistic view of contributions vis-à-vis predefined goals. By harnessing the power of mobile money, we aim to minimize individual charges incurred during multiple transactions,” Amanya emphasized.

Beyond its convenience, SharePay’s impact is multifaceted. It not only simplifies expense sharing but also minimizes financial disparities caused by varying charges incurred through individual transactions. The platform’s collaborative nature ensures that costs are equitably distributed among group members, thereby reducing the financial burden on individuals.

“By aggregating contributions within a single platform, SharePay aims to promote financial transparency and fairness among group members. Our vision is to minimize the financial burden on individuals while fostering a sense of financial inclusivity within groups,” Amanya said.

As SharePay charts its course in the realm of shared expense management, its legacy appears to be rooted in pioneering a shift toward equitable and transparent financial practices within groups.

MTN MoMo Hackathon

The MTN MoMo Hackathon 2023 was the third edition and was held under the theme “Innovative Financial and Transactional Applications”. The hackathon is an innovative platform designed by MTN Mobile Money Uganda Limited to bring together visionary web developers and entrepreneurs from across Africa.

The hackathon aims to harness the power of technology and creativity to accelerate financial inclusion and drive the digitization of payments on the continent.

Beyond the competitive spirit, MTN MoMo Hackathon 2023 fostered an environment ripe for creativity, collaboration, and the exchange of transformative ideas.

The hackathon itself wasn’t just about putting projects against each other in a race for recognition and rewards. It served as a melting pot of aspirations, where technologically savvy minds converged to transform everyday inconveniences into opportunities for innovation.

ALSO READ: Safaricom, M-PESA Africa, Sumitomo Call for Applications for the Spark Accelerator Program