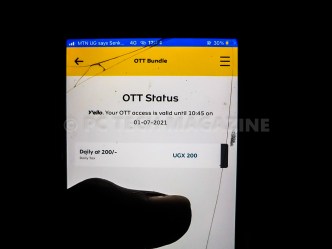

Effective today (July 1st, 2021), Ugandans online will no longer have to pay a levy to use Over-the-Top (OTT) services —after the government at the tail of April, this year came to the conclusion to drop the tax and instead tax mobile internet data directly. Therefore, Ugandans can now access/use social media platforms without OTT tax or using Virtual Private Networks (VPNs).

Dropping the levy on OTT, the government imposed a 12% on mobile internet which is one of the seven taxes of the Excise Duty (Amendment) Bill 2021 that the Members of Parliament [the 11th Parliament] agreed to put in place starting this financial year (July 1st, 2021).

The State Minister for Finance, Planning, and Economic Development, Hon. Amos Lugoloobi, while presenting the Financial Year 2021/22 budget on June 14th, 2021, said the excise duty is tailored towards enabling the country to attain industrialization for inclusive growth, employment, and wealth creation.

While paying OTT was optional, the tax on mobile internet is mandatory but will be exempted for medical and education services.

Mobile data is what allows your phone or tablet to access the internet even when you’re not on Wi-Fi —giving you an internet connection anywhere as long as you’re connected to a cellular network. However, this comes with a cost as ISPs and telecoms already charge for mobile data used over a cellular connection to let you browse the web, use apps, read emails, live stream & watch online videos, play games, socialize, to mention a few. Everything you send to (upload) or receive from (download) the internet requires some amount of data. And to use this data, you will have to pay the 12% tax which the government is going to charge every time one buys data for internet use.

With the OTT tax now removed, there could be an increase in the cost of mobile data which is already high. However, in 2019 Frank Tumwebaze who by then was the Minister of ICT and National Guidance, said, “With or Without OTT tax, the cost of mobile data will remain high,” emphasizing that removing the tax won’t influence mobile data prices.

The proposal by the government to revoke the widely-opposed OTT tax that was introduced in 2018 followed a revelation by Doris Akol who by then was the Commissioner-General of the Uganda Revenue Authority (URA) proposed to Parliament’s Finance Committee about plans to drop OTT tax and instead impose a direct tax on mobile data. She underscored the need to have the tax policy reviewed since it was not performing well.

“Proposing to amend Schedule Two of the Excise Duty Act to look at possibly putting excise duty on mobile data —this would counteract the effects of OTT and make it a bit more efficient to collect tax on data instead of the OTT which is highly evaded and is not performing well,” Akol said.

To repeal the tax which has been regarded as the worst-performing tax by URA came after a Market Performance Report issued by the Uganda Communications Commission (UCC) indicating that the number of internet subscribers who are not paying the OTT tax was at least 7.6 million of the target 18.9 million subscribers. Collections from the tax introduced in 2018 have been below as users avoided it by using VPNs or Wi-Fi connections.

URA in July 2019 said they had collected only UGX49.5 billion out of the targeted UGX284 billion from OTT for Financial Year 2018/2019, a short-fall of 83 percent.

The government taxing mobile internet might in one way or the other affect their e-Governance strategy which was introduced to revolutionize how the government operates as well enhance their relationship with citizens and business communities.

The e-Governance strategy is being spearheaded by the National Information Technology Authority (NITA) Uganda who are enforcing and pushing for e-Service delivery across all government MDAs. The government through NITA Uganda is ensuring that there’s automation of service delivery for government MDAs resulting in the development of information systems to support the provision of e-services to the public.